Guest post – Essential Information Group

Property Auction Insights September 2024

In this edition, we delve into two topics. In the first, we examine the mindset of an auction buyer, focusing on the strategies that lead to success in this fast-paced environment, and reasons why a bidder may walk away during the process. Secondly, we explore the flattening of the auction cycle as market dynamics shift towards greater consistency year-round. Together, these topics offer valuable perspectives on how buyers and investors can navigate and thrive in the evolving auction landscape.

Focus on: The Mindset of an Auction Buyer

Buying property at auction can be an exhilarating and high-stakes experience. Unlike traditional property purchases where the process can involve lots of negotiation over a matter of days or weeks; and with risk of gazumping and gazundering possible until exchange; auctions condense the process into a few intense moments. The mindset of an auction buyer is shaped by a blend of preparation, strategy and psychology.

Habits of Auction Buyers

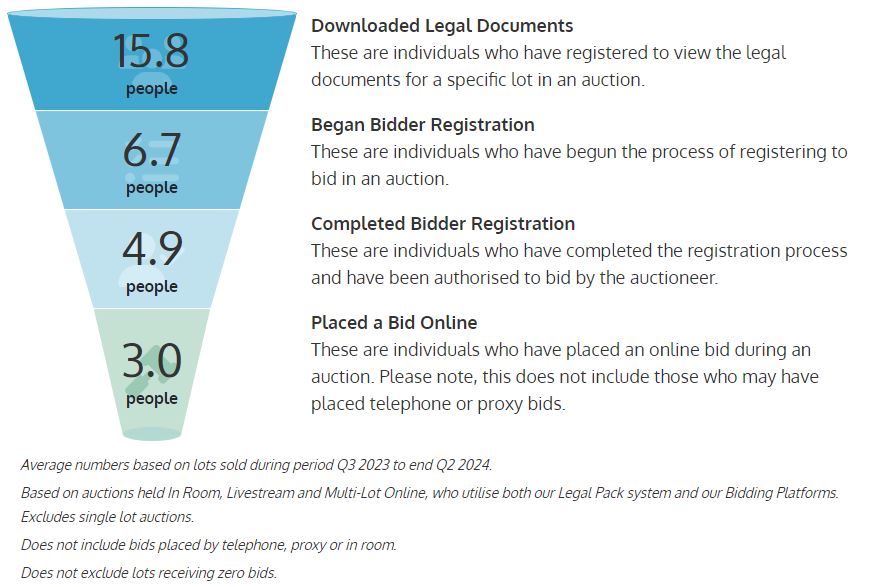

At the core of this mindset is due diligence. Successful auction buyers know that preparation is key and before even considering a bid, a successful buyer will thoroughly research the property, download and scrutinise the legal pack, and often seek advice from solicitors and other professionals such as surveyors. This ensures they are fully aware of any legal issues, potential costs or risks associated with the property.

Once a potential buyer has read the legal pack, they have to decide whether any risks outlined in the documents are too great to warrant placing a bid or whether they believe they could proceed regardless. This is the point we see the largest drop off in terms of interest levels.

For those who decide they wish to place a bid, any interested party must begin and complete the registration process to be permitted to bid. There are several reasons why a person may choose to walk away before finishing registration. New information may have become available, which is why it is key to review any updates to the legal pack. Your situation may have changed, so you can no longer purchase the property in question. One aspect to also keep in mind is that nowadays many auctioneers do require a hold on funds to be placed prior to the auction. This is to ensure only those serious about purchasing a property are permitted to bid.

Why would someone who is authorised to bid not actually place a bid on auction day? Any new information about the property or a change in circumstances for the individual. It must also be considered that aspects such as internet connection can play a part, or indeed being the successful winning bidder on an alternative lot could also come into play. Ultimately though, it’s important to remember that there can only be one winning bidder per lot, but to stand a chance of that being you, you will need to ensure you have satisfied your own due diligence and completed all necessary registration steps to be able to take part.

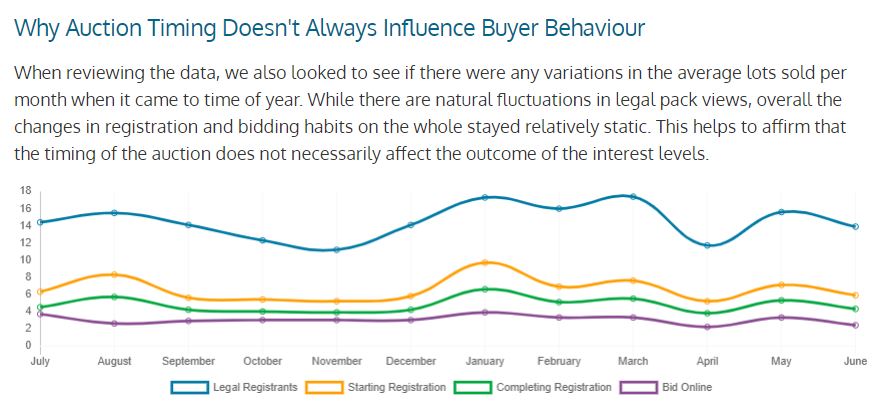

When reviewing the data, we also looked to see if there were any variations in the average lots sold per month when it came to time of year. While there are natural fluctuations in legal pack views, overall the changes in registration and bidding habits on the whole stayed relatively static. This helps to affirm that the timing of the auction does not necessarily affect the outcome of the interest levels.

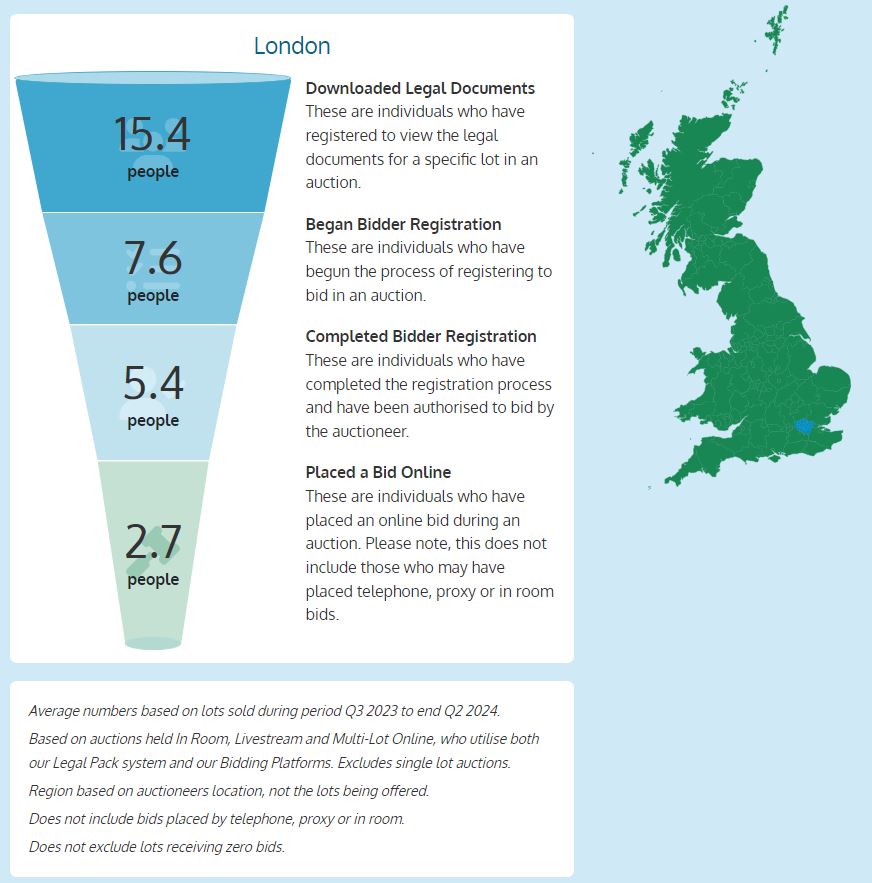

Where you buy can be just as important. Regional variations in property markets, legal frameworks, and cultural norms can significantly influence auction outcomes and the strategies that bidders should employ and should be included in the mindset of an auction buyer.

Local Market Conditions play a pivotal role in shaping bidding strategies. In high-demand regions, such as major cities, property auctions can be highly competitive, with aggressive bidding and higher final sale prices. Buyers in these areas may need to adopt more assertive tactics and be prepared to stretch their budgets. Conversely, in areas with lower demand such as rural or economically challenged regions, auctions might see less competition, allowing bidders to adopt a more conservative approach and potentially secure properties at a lower price.

The demographics of the buyer pool can also vary by region, influencing the overall auction atmosphere. In areas with a high concentration of investors, bidding may be driven by considerations of return on investment and long-term market trends, leading to more calculated and financially driven tactics. In regions where owner-occupiers dominate, emotional factors, such as a desire for a dream home, can lead to more impulsive or aggressive bidding.

Local knowledge plays a significant role in auction success. Local buyers often have a deeper understanding of the market, neighbourhood dynamics, and future developments that can influence a property’s value. This knowledge allows them to make more informed decisions and adopt bidding strategies that leverage their insights. On the other hand, out-of-region buyers may approach the auction with different perceptions, sometimes overvaluing properties due to a lack of local context, which can lead to unexpected competition and price escalation.

Focus on: The Flattening of the Auction Cycle Curve

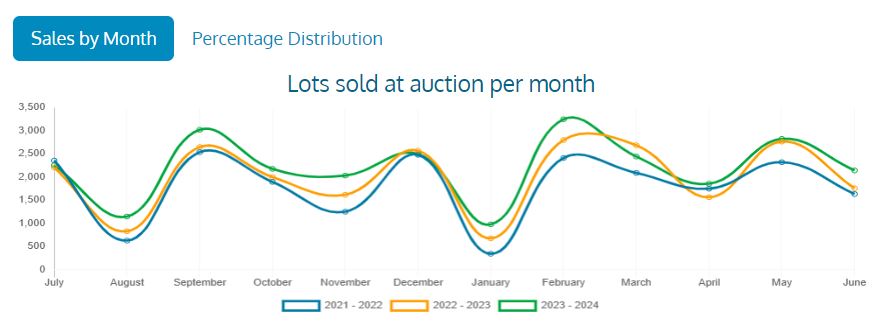

Traditionally, the property auction market has exhibited distinct seasonal patterns. There have been well-established quiet periods, notably in January, April, August, and November. These lulls were influenced by a range of factors, primarily caused by external factors such as the financial year timings as well as holiday seasons. However, recent data suggest a shift is occurring within the auction cycle – one that is seeing the curves are beginning to flatten out and previously quieter months becoming more active.

Changing Patterns in Auction Sales

Analysing the data from the past three years, it becomes evident that the property auction market is evolving. The number of lots sold each month across the years 2021-22, 2022-23, and 2023-24 reflects this shift. The data shows a gradual increase in lots sold during traditionally quiet months like January and November, coupled with a slight decline in the extreme peaks of the busier months like September and October.

For instance, in the financial year 2021-22, only 340 lots were sold in January, a stark contrast to the 2,480 lots sold in December of the same cycle. By 2023-24, January saw a notable rise, with 976 lots sold – an increase of over 180% compared to 2021-22. This trend is similarly observed in other traditionally quiet months, such as November and August.

Conversely, months that were once bustling with activity; like September and October; are experiencing a tempering of sales. While these months still see a high volume of transactions, the extreme spikes observed in previous years are becoming less pronounced. September 2021-22 for instance, saw 2,538 lots sold compared to 3,023 in September 2023-24, a significant increase, but when viewed as a percentage of the monthly average, the rate of growth has moderated.

A More Balanced Market

When we started to look at the percentage split of lots across the year it further underscored that the curve is beginning to show signs of flattening. This approach allows us to see how the distribution of sales are spread across the year.

In the 2021-22 cycle, the variance between the busiest and quietest months was stark. For example, September accounted for 12% of the annual total while January saw only 2% of sales. This indicates that September was a significantly busier month, whereas January was exceptionally quiet and by the 2023-24 cycle these extremes had started to moderate. September remains a busy month, holding steady at 11%, but the difference isn’t as pronounced as it was in 2021-22. Meanwhile, January has increased to 4%, showing a rise in activity during what was traditionally the quietest period of the auction calendar.

This flattening of the curve suggests that the auction market is becoming more consistent throughout the year, with less dramatic swings between busy and quiet months. This consistency is largely attributed to the move into online sales as well as the ability to hold livestream events with greater flexibility and cost than the traditional ballroom sales. This flexibility has enabled a year-round opportunity for sales, aiding the smoothing out of the cycle and reduced seasonal dependencies, which in turn alleviates the pressures on the auction teams themselves.

This in addition to advances in PropTech; such as our very own auctioneer software AMS; have bolstered the property auction industry, bringing a wave of innovation while the broader property market works to catch up. For years, the auction sector has already had key elements in place, such as the online availability of essential material information and property particulars, allowing buyers to make informed decisions with ease. Online bidding platforms and remote buying solutions have streamlined the process, enabling buyers to participate in auctions from anywhere in the world. Services like Viewber have further enhanced accessibility, offering on-demand property viewings that remove normal barriers for both viewing reps and potential buyers. These technologies provide transparency, convenience, and efficiency, creating a dynamic and accessible auction environment for all involved while other sectors of the property market are only beginning to adopt similar advancements.

The flattening of the property auction cycle indicates we are seeing a significant evolution in the market. While there are still fluctuations between months, the extremes are moderating, leading to a more balanced distribution of auction activity throughout the year. This shift could be beneficial for the market, providing greater predictability and stability, and allowing both buyers and sellers to plan with more confidence. As the property auction landscape continues to evolve, staying attuned to these trends will be crucial for all market participants.

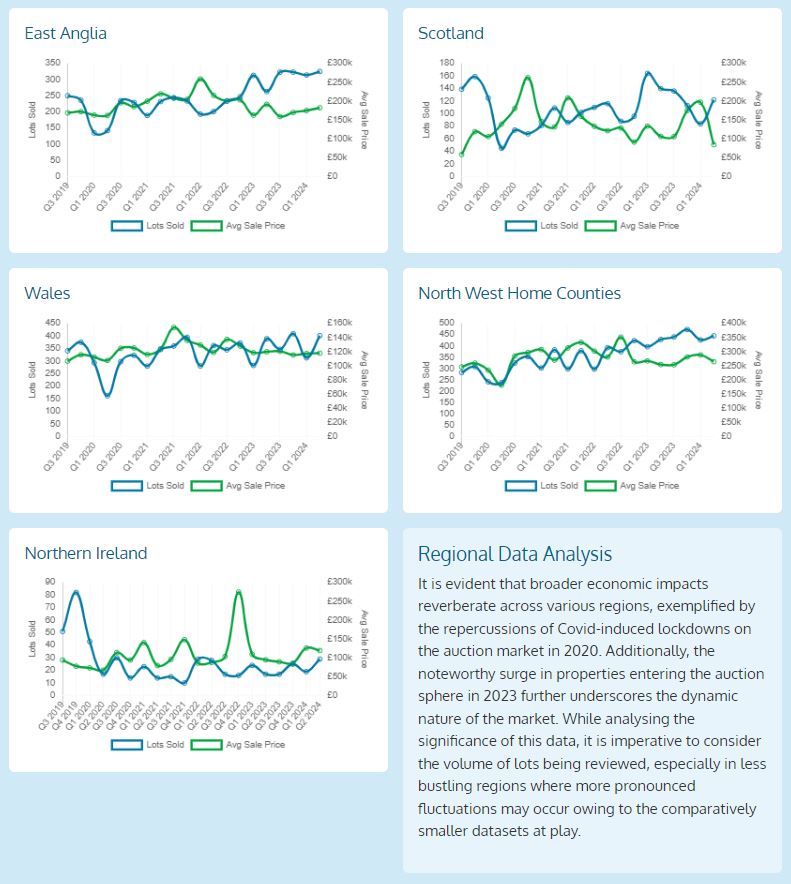

Regional Data

Every quarter we will be including regional data from the past five years, including the number of lots sold and the average sale price, and now average yield too. This allows you to track what is happening across the country, to spot trends, and see how changes in the wider market may be affecting auctions.

The data in these charts consist of all auction sales on a quarterly basis, including individual single lot sales.

Closing Summary

It is clear the auction landscape calls for buyers and sellers to adopt a mindset that combines flexibility with strategic foresight. As the auction cycle flattens and becomes more consistent, buyers are no longer confined to the traditional peaks of activity. This shift allows for more deliberate, well-researched decisions and the opportunity to approach auctions with increased confidence. By focusing on long-term goals, thorough market analysis and emotional discipline, auction buyers and sellers alike can better position themselves to capitalise on opportunities in this more predictable and stable environment.

David Leary

PS. EIG’s next edition will be released in December 2024, so if you are not already on our newsletter mailing list, sign up today!

Disclaimer: The figures in this newsletter are based on sales data provided to us by the auctioneers.

Please click here for access to the original newletter.